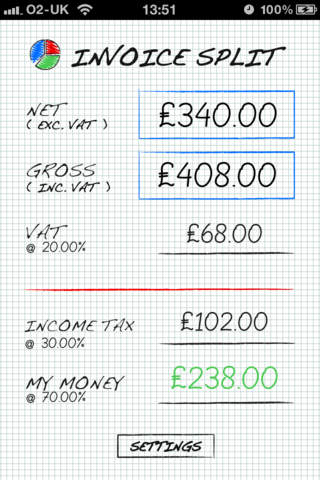

Invoice Split helps you to easily work out how much you need to put aside for the HMRC and how much is your money to spend. It splits out all the basic components of an invoice from either the gross or net amount. VAT, income tax, and your money are all clearly calculated from one entry.

Easily set the percentage you want to save and the amount of VAT you need to charge/save for each invoice.

Perfect for anyone that invoices such as self employed sole traders or registered for VAT contractors. Dont worry about getting caught short by HMRC next time you have a tax installment or VAT bill due!